Zero Moving Cost Home Loan Malaysia 2022 Is this a better choice. Malaysia Housing Loan Interest Rates.

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Fill in your details such as name contact email and property location.

. Rated Excellent on Trust Pilot. At the moment the average rate for a 30-year fixed rate mortgage is 399 percent with actual offered rates ranging from 313 percent to 784 percent on the market. Malaysia Lending Interest Rate is at 344 compared to 394 last year.

Malaysia Home LoanFinancing Features. Generate principal interest and balance loan repayment table by year. The Government recently reduced the minimum price threshold from RM1million to RM600000 for foreign property purchase with selected properties and projects.

Malaysia Raises Key Rate to 225 The central bank of Malaysia raised its key overnight policy rate by 25 basis points to 225 in its July 2022 meeting the second consecutive rate hike and in line with market expectations. Due to Central Negara having frontloaded rate hikes in the early part of this year we notice more flexibility in keeping to a fairly neutral position. Ad Find The Right Loan For You By Comparing Our Best Deals Online.

Use our home loan calculator to get an estimation of your monthly instalment based on your desire loan amount and tenure. Malaysias Government always encourages foreigners to choose Malaysia as their second home whether for a long-term stay retirement or investment purposes. Interest rates for housing loans in Malaysia are usually quoted as a percentage below the Base Rate BR.

Its fast and easy apply online today. Youll need to compare the types of housing loans available to you offered by various banks and lenders as well as learn about interest rates flexi semi-flexi and non-flexi loan options. Compare the cheapest home loans from over 18 banks in Malaysia.

For example if the current BR rate is 400 Update. Quote Direct From The Lender. For example the loan is suppose 500000 if the interest provided by A bank is 450 and the B bank provides 500.

Base Rate BR 125 XX Base Rate 175 125 3 So 3 per annum is the interest rate for your home loan. 1Standardised Base Rate SBR as at 1 August 2022 is 225 pa. Second a fixed 539 annual interest but with zero moving cost.

Get interest rates from as low as 415 on your housing loan. If youve heard about Flexi and Non-Flexi home loans it could mean different things some flexi-loans offer the option to make more payment to save on interest or even make withdrawals on pre-payments and be charged a fee in case you need the cash. Many borrowers would thus strive to make extra payments or larger amounts.

Third you can get 439 annual interest for the first two years and 515 on the rest after. Enter property price in Malaysian Ringgit. Therefore decreasing their principal loan amount as well as reducing the interest owing.

Interest rates rise over next 3-6 months unlikely Central bank is likely to pause rates again at their following discussion at Nov 12 states Senior Economist at AmResearch. Contact Us At 6012-6946746. 5 Cara Bijak Untuk Refinance Rumah 2022.

Youve got questions Weve got answers. Interest after each instalment Outstanding principal loan x Rate of interest. This means that your legal costs and insurance fees will be lessened upfront.

For instance a flexi option allows you to put withdrawable additional money in your loan account while a semi-flexi loan means youll get charged when withdrawing money from the account. 3 REASONS WHY YOU SHOULD CHOOSE ZERO MOVING COST HOME LOAN 2022. Lima Cara Bijak Untuk Refinance Rumah 2022.

The home loan application process in Citibank is simple and quick. House for Sale House for Rent Property for sale for rent Real Estate Malaysia Interest Rates Loan Packages. REPAYMENT If you have a bank letter offer the bank will stated how much monthly installment youll need to pay monthly and for how long.

It could also mean that they offer a lower initial monthly repayment. Central Bank of Malaysia 1Y 5Y 10Y 25Y MAX Chart Compare Export API Embed Malaysia Bank Lending Rate. Malaysia Bank Lending Rate - July 2022 Data - 1996-2021 Historical - August Forecast Malaysia Bank Lending Rate Bank Lending Rate in Malaysia increased to 379 percent in June from 368 percent in May of 2022.

Employment Governance and Policy Governmental Statistics. Home loan interest rates for all banks in 2022. Discounted Rate From 399.

THE PRICE OF KEMALASAN BNM Increases the OPR from a record low of 175 to 200. Ad Find The Right Loan For You By Comparing Our Best Deals Online. First youll pay a fixed interest at the rate of 499 annually for the term of the loan.

Do a quick calculation on your monthly repayments using our online housing loan calculator and save more. Ad Get a Secured Loan For Home Improvements Or To Consolidate Your Debts. Enter housing loan period in Years.

For example like this. Enter down payment amount in Malaysian Ringgit. Browse through a vast selection of bank loan packages using our mortgage tool.

Base Lending Rate BLR 66 Maximum Loan Amount 90 of property price. Interest rates for home loans with shorter durations or adjustable rate arrangements are often cheaper on average. By 420 monthly installments of RM1464 each for 35 years.

Enter loan interest rate in Percentage. Although the difference is only 05 of the district it will eventually have to be spend with an amount of more than RM35000. Click on Apply Now.

Please visit any of our CIMB Bank branches for promotional profit rate. Heres the formula along with an example assuming your house loans outstanding principal on the 1st month is RM450000 and your interest rate is 30 pa Outstanding Principal x Interest Rate12 Interest payable per instalment RM450000 x 00025 RM1125. As of 2nd January 2015 Base Lending Rate BLR has been updated to Base Rate BR to reflect the recent changes made by Bank Negara Malaysia and subsequently by major local banks the interest rate on a BR.

This is lower than the long term average of 698.

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Malaysia Interest Rate Malaysia Economy Forecast Outlook

Latest Base Rate Base Lending Rate Malaysia Housing Loan

Best Low Interest Rate Housing Loans In Malaysia 2022 Compare And Apply Online

2019 Bank Mortgage Interest Rates Malaysia

Latest Base Rates Br Base Lending Rate Blr Interest Rates Mypf My

Finance Malaysia Blogspot Update Local And Foreign Banks Mortgage Loan Rate As Of 6 March 2020

2019 Bank Mortgage Interest Rates Malaysia

Best Housing Loans In Malaysia 2022 Compare And Apply Online

2019 Bank Mortgage Interest Rates Malaysia

New Reference Rate In Malaysia Effective 2nd January 2015 Base Rate Br

Finance Malaysia Blogspot Update Local And Foreign Banks Mortgage Loan Rate As Of 6 March 2020

Lppsa An Easy Housing Loan Guide For Government Workers New Property Nuprop

Bangkok Bank Al Rajhi Bank Bank Muamalat Have Highest Indicative Effective Lending Rates While Alliance Bank Public Bank Bsn Have Lowest The Edge Markets

The 7 Best Housing Loans In Malaysia 2022

Latest Base Rate And Base Lending Rate For The Major Banks In Malaysia As At 1 8 2016 Malaysia Housing Loan

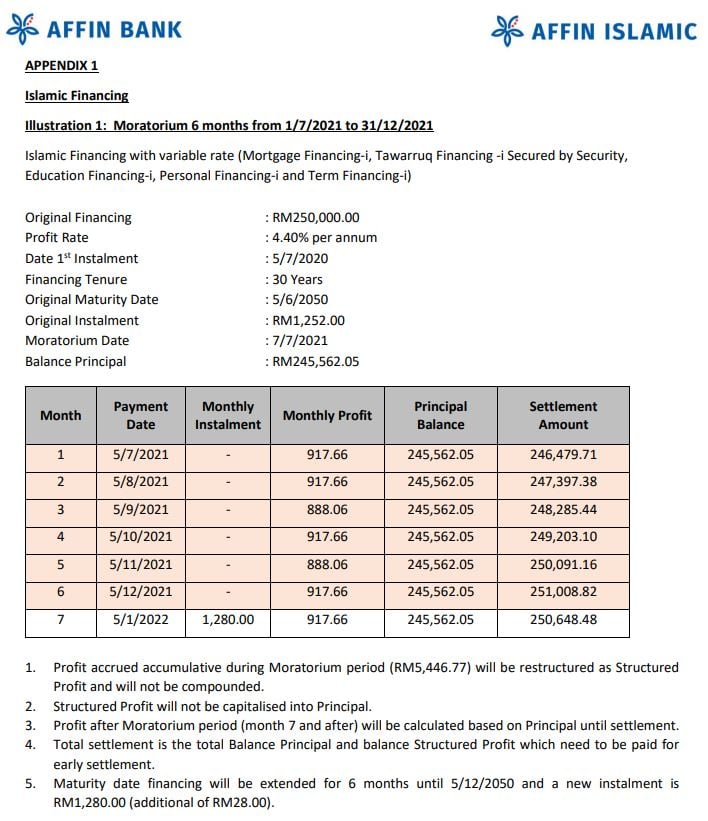

Malaysia Loan Moratorium 2021 Guide Should You Take The 6 Month Deferment For Your Loans

How To Calculate Flat Rate Interest And Reducing Balance Rate